India’s Generic Drug Industry: Feeding the World’s Medicine Needs

When you pick up a bottle of generic antibiotics, blood pressure pills, or diabetes medication in the U.S., the UK, or Kenya, there’s a very good chance it came from India. The country doesn’t just make medicine-it supplies the world. India produces about 20% of all generic drugs shipped globally by volume, and more than 60% of the world’s vaccines. That’s not a small number. It’s the backbone of healthcare for billions.

How did this happen? It started with a legal decision. In the 1970s, India changed its patent laws to allow local companies to copy branded drugs after the original patent expired. No need to pay expensive licensing fees. No need to wait for permission. Just reverse-engineer, produce, and sell at a fraction of the cost. That move turned India into a manufacturing giant. Today, over 10,000 drug factories operate across the country, and more than 650 of them meet U.S. FDA standards-the most outside the U.S. itself.

Why Indian Generics Are So Much Cheaper

Indian generics cost 30% to 80% less than the same drugs made in the U.S. or Europe. Why? It’s not magic. It’s scale, efficiency, and lower labor costs. Companies like Sun Pharma, Cipla, and Dr. Reddy’s don’t spend billions on marketing. They focus on making high-quality versions of older drugs that are off-patent. These are not new inventions-they’re proven treatments. That means less R&D risk, lower costs, and faster production.

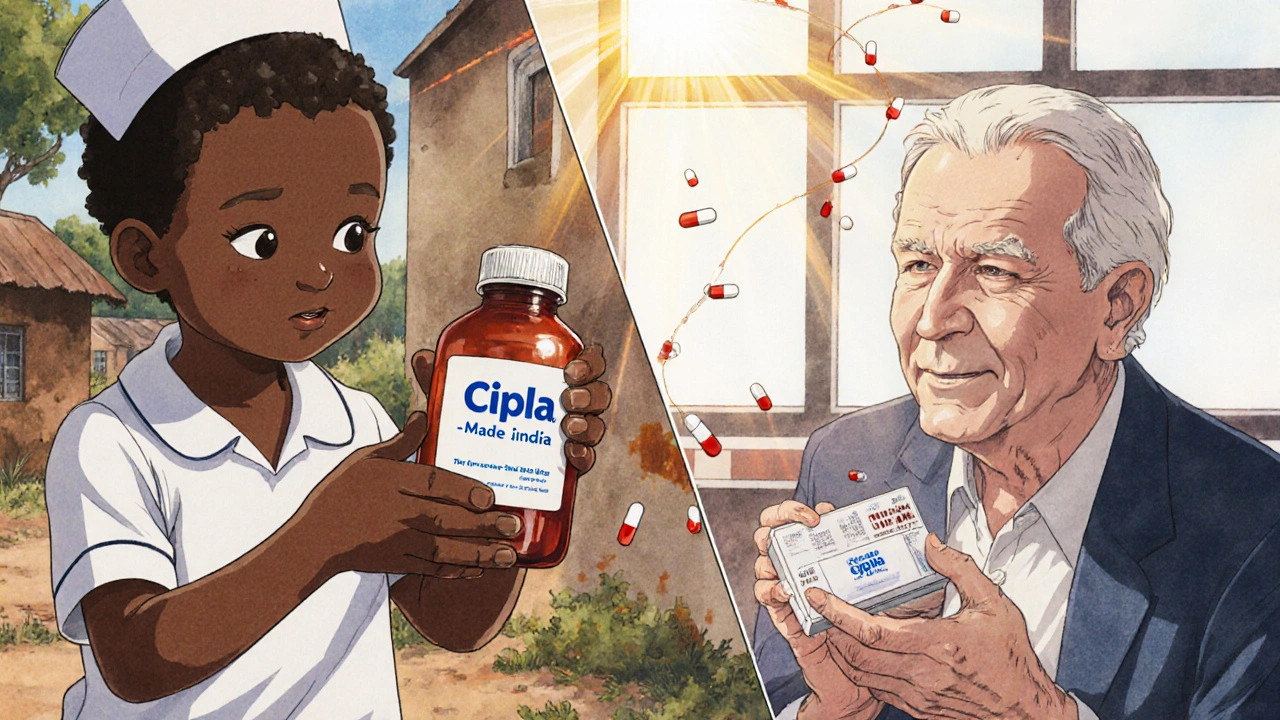

For example, a year’s supply of HIV antiretrovirals used to cost $10,000 per patient. Indian manufacturers brought that down to under $100. That’s how millions in Africa and Southeast Asia got access to life-saving treatment. The same thing happened with hepatitis C drugs, cancer medicines, and insulin. In the U.S., Indian generics make up about 40% of all dispensed generic prescriptions. In the UK, they’re 33% of NHS prescriptions. In Sub-Saharan Africa, it’s closer to 50%.

Who Makes These Drugs? The Big Players

India’s generic market isn’t run by one company. It’s led by a handful of giants with global reach:

- Sun Pharma-the largest Indian pharma company by market value, with over $43 billion in worth. They make everything from skin creams to complex injectables.

- Cipla-famous for bringing down the cost of AIDS drugs in the early 2000s. Still a major supplier of respiratory and antiviral medicines.

- Dr. Reddy’s Laboratories-strong in biosimilars and complex generics, with a big presence in the U.S. and Europe.

These companies don’t just sell pills. They export active pharmaceutical ingredients (APIs)-the actual chemical ingredients that make drugs work. India produces over 500 different APIs, but here’s the catch: about 70% of those APIs come from China. That’s a huge dependency. If China cuts supply, India’s factories could slow down.

Quality Control: Trust But Verify

For years, Indian drug factories were seen as risky. The FDA issued warning letters. Some batches were recalled. But things have changed. Today, 85% to 90% of Indian plants pass FDA inspections-matching the global average. That’s a big jump from 60% in 2015.

Why the improvement? Global buyers demanded it. The U.S. and EU don’t just accept any shipment. They inspect factories. They test samples. They audit documentation. Indian companies had to upgrade. They hired more quality control staff. They installed better lab equipment. They moved from paper records to digital systems. Now, 92% of Indian manufacturers can submit electronic regulatory documents (eCTD), which is the global standard.

Still, problems happen. A Reddit user in 2024 reported inconsistent absorption rates in a batch of Indian-made levothyroxine. Some UK patients complained about taste differences. A few shipments arrived with mismatched labels. These aren’t mass-scale failures. They’re outliers. But they matter. One bad batch can shake trust.

Exports vs. Value: The Hidden Gap

India is the world’s top exporter of generic drugs by volume. But it’s not the top earner. Why? Because it sells low-cost pills, not high-margin ones. India accounts for only 10% of the $70 billion U.S. generic drug market by value-even though it supplies 30% of the volume. That’s the trade-off: high quantity, low price.

Compare that to China. China makes cheaper APIs, but it has only 153 FDA-approved plants compared to India’s 650. So while China can supply raw materials, it can’t match India’s ability to turn those materials into finished, regulated medicines ready for global markets.

Europe’s big generic makers like Teva and Sandoz charge more. They focus on niche markets-specialized formulations, rare diseases, complex delivery systems. India is starting to move that way too. Biosimilars-highly complex versions of biologic drugs like Humira or Enbrel-are now 8% of India’s export value, up from just 3% in 2020. Companies like Biocon are spending over $500 million a year on this. It’s the next frontier.

The Push for Self-Reliance: Fixing the API Problem

India’s biggest weakness? It relies on China for 70% of its active ingredients. That’s risky. During the pandemic, when China shut down factories, India felt the pinch. Drug shortages started popping up. That’s when the government stepped in.

In 2020, India launched a ₹3,000 crore ($400 million) Production Linked Incentive (PLI) scheme to boost local API production. The goal? Cut reliance on China and reach 53% self-sufficiency by 2026. It’s not easy. Building an API plant costs $20 million to $50 million. It takes 18 to 24 months to get approved. Only a few companies have the capital to do it. But progress is happening. New plants are opening in Gujarat, Telangana, and Maharashtra.

There’s also Pharma Vision 2047-a government plan to make India a $190 billion pharmaceutical exporter by 2047. That’s more than triple today’s exports. To get there, India must move beyond low-cost pills. It needs to become a leader in biosimilars, inhalers, transdermal patches, and other complex products.

Real-World Impact: From Africa to America

Ask a doctor in Nigeria what they use for malaria treatment. Chances are, they’ll say an Indian-made generic. Doctors Without Borders reported in 2024 that Indian antimalarials cut treatment costs by 65% while keeping 95% efficacy. In the U.S., patients on Medicaid or Medicare rely on Indian generics to save hundreds a month. PharmacyChecker.com found 87% of users were satisfied with the quality-mostly because they could afford their meds.

In the UK, the NHS saves millions by buying Indian generics. One patient review on NHS Choices said: “My blood pressure pills cost £2 a month instead of £15. I’d go without if it weren’t for this.” That’s the real impact. It’s not about brand names. It’s about access.

What’s Next for Indian Generics?

The future isn’t just about making more pills. It’s about making better ones. India’s next big bet is on complex generics and biosimilars. These aren’t easy to make. They require advanced technology, strict controls, and deep expertise. But the profit margins are higher. And the world needs them.

Regulatory hurdles remain. Getting FDA approval still takes 3 to 5 years for new companies. About 35% to 40% fail their first inspection. Translation errors in documents still cause delays. But the trend is clear: quality is rising, ambition is growing, and global demand is too big to ignore.

India won’t replace the U.S. or Germany as a hub for drug innovation. But it doesn’t need to. Its role isn’t to invent the next miracle drug. It’s to make sure that when a drug becomes affordable, everyone can get it. That’s the real power of India’s generic industry.

Are Indian generic drugs safe to use?

Yes, the vast majority are. Over 650 Indian drug plants are approved by the U.S. FDA, and more than 2,000 meet WHO-GMP standards. Compliance rates have jumped from 60% in 2015 to 85-90% today. While isolated cases of quality issues have occurred, they are rare and usually tied to specific batches-not the entire industry. Regulators inspect factories regularly, and most Indian manufacturers now use digital systems to track quality control.

Why are Indian generic drugs so much cheaper than branded ones?

Indian manufacturers don’t pay for expensive R&D or global marketing. They copy drugs after patents expire, use low-cost labor, and produce at massive scale. They also benefit from India’s historical decision to allow generic production without product patents. This lets them sell the same active ingredients at 30-80% lower prices. The savings are passed on to patients, hospitals, and governments worldwide.

Does India make all its own drug ingredients?

No. India imports about 70% of its active pharmaceutical ingredients (APIs) from China. This is a major vulnerability. To fix it, the Indian government launched a $400 million incentive program to build domestic API plants. The goal is to reach 53% self-sufficiency by 2026. Progress is slow but steady, with new facilities opening in Gujarat and Telangana.

Which countries rely the most on Indian generic drugs?

The U.S. gets about 40% of its generic prescriptions from India. The UK imports 33% of its generic medicines from Indian manufacturers. In Sub-Saharan Africa, India supplies roughly half of all pharmaceuticals. Countries in Latin America, Southeast Asia, and the Caribbean also depend heavily on Indian generics due to their affordability and regulatory compliance.

Is India moving beyond basic generics?

Yes. Indian companies are now investing heavily in biosimilars-complex versions of biologic drugs like insulin or cancer treatments. Biosimilars now make up 8% of India’s pharmaceutical exports, up from 3% in 2020. Companies like Biocon and Dr. Reddy’s are spending over $500 million a year on this. They’re also developing complex delivery systems like extended-release tablets and transdermal patches, which command higher prices and better margins.

Final Thoughts: More Than Just Pills

India’s generic drug industry isn’t just about business. It’s about survival. For millions in low-income countries, these medicines are the only way to treat chronic illness. For patients in rich countries, they’re the only way to afford treatment without going bankrupt. The world needs this supply chain. And as long as cost and access remain critical, India will keep playing its role-not as a replacement for innovation, but as the engine that makes innovation usable for everyone.

Comments

Josh Evans

Been using Indian generics for my blood pressure meds for years. Never had an issue, and I save like $150 a month. My pharmacist even says they’re FDA-approved and just as good as the brand name.

On November 30, 2025 AT 07:28

Allison Reed

It’s wild to think that something so vital to global health is so underrated. These aren’t just cheap pills-they’re lifelines. People in Kenya, Nigeria, even rural America-they’d be screwed without Indian generics. Hats off to the industry.

On November 30, 2025 AT 21:11

Jacob Keil

they say india is the pharmacy of the world but have you seen the chinese factories making the actual chemicals? we’re just assembling someone else’s magic dust. this whole thing is a house of cards built on silicon valley dreams and cheap labor

On December 2, 2025 AT 02:09

Rosy Wilkens

Let’s be real-how many of these ‘FDA-approved’ plants are just bribing inspectors? I’ve seen reports where batches get flagged for impurities, then mysteriously cleared after a ‘re-inspection.’ This isn’t healthcare-it’s a global shell game.

On December 3, 2025 AT 11:37

Andrea Jones

Okay but have you ever tried Indian levothyroxine? The taste is… weird. Like metallic chalk. I switched back to the US version and my thyroid felt better immediately. Coincidence? Maybe. But I’m not risking it again.

On December 4, 2025 AT 09:35

Justina Maynard

India’s entire pharma model is a beautiful paradox: they’re the most ethical drug producers on earth-until you realize they’re literally outsourcing their soul to China. 70% of APIs? That’s not supply chain, that’s economic colonialism with a smile.

On December 4, 2025 AT 13:13

Evelyn Salazar Garcia

Why are we importing medicine from a country that can’t even clean its rivers? This is dumb. We should be making our own pills. America first.

On December 6, 2025 AT 03:08

Clay Johnson

Access over innovation. That’s the mantra. But what is innovation if not access made visible? The world doesn’t need more pills. It needs meaning behind them.

On December 7, 2025 AT 16:18

Jermaine Jordan

Imagine a world where every child in Malawi gets their HIV meds because someone in Hyderabad refused to let profit dictate survival. THIS is the quiet revolution. Not in boardrooms. Not in labs. In factories. In vials. In hope.

On December 8, 2025 AT 02:56

Yash Hemrajani

Oh wow, another love letter to Indian pharma. Let’s not forget the 2018 recall of 12 million tablets because of carcinogens. Or the 2021 batch of metformin with NDMA. Yeah, 90% pass FDA inspections-so what? That means 1 in 10 still slips through. And we’re supposed to be grateful?

And don’t get me started on the ‘low cost’ myth. You think a $5 insulin vial is cheap? Try telling that to the family who lost their dad because the pharmacy ran out last month. It’s not cheap-it’s just invisible until it fails.

Meanwhile, Indian CEOs drive Teslas and send their kids to Stanford. The workers? Paid $3/hour to fill vials while breathing in chemical fumes. This isn’t humanitarianism. It’s capitalism with a conscience patch.

On December 9, 2025 AT 17:37

Chetan Chauhan

u think india is the pharmacy of the world? lol. u forgot to mention they cant even make their own toilet paper properly. how can they make life saving drugs? its all smoke and mirrors. also why do all the pills taste like plastic? its a scam.

On December 10, 2025 AT 06:06

Pranab Daulagupu

API dependency is real but overblown. India’s PLI scheme is working-new plants in Gujarat are already hitting 15% domestic output. And biosimilars? That’s the real game-changer. We’re not just copying anymore-we’re engineering. The future isn’t in volume, it’s in complexity.

On December 10, 2025 AT 17:17

Pawittar Singh

Bro, let me tell you something-my grandma in Delhi takes Indian-made insulin. She’s 82. Still walks 3 miles every morning. No hospital visits in 5 years. You think this is just about profit? Nah. This is about dignity. People like us? We don’t get to pick the brand. We pick survival. And India gave us that. So shut up and thank them.

And yeah, maybe the APIs come from China. So what? We’re not building rockets here. We’re building hope. One pill at a time. 🙏

On December 11, 2025 AT 23:46

Phil Thornton

China makes the stuff. India bottles it. The US pays for it. Everyone wins. Except the people who actually make it. But hey, at least the pills work.

On December 13, 2025 AT 09:31

Alexander Levin

They're all being monitored by the CIA. The FDA is just a front. The real control is in the API supply chain. China owns you. 💀

On December 13, 2025 AT 16:00